Calculate 401k contribution per paycheck

The average employer contribution dollar amount into 401ks in 2019 was 4100 which equates to a little bit more than 1000 per quarter Some 401k plans vest employer. A 401 k can be one of your best tools for creating a secure retirement.

After Tax Contributions 2021 Blakely Walters

For 2021 the maximum contribution for this.

. Use our retirement calculator to see how much you might save by the time. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and.

Please note that your 401k plan contributions may be limited to less than 80 of your income. Retirement Calculators and tools. Find out how much you should save using NerdWallets 401k Calculator.

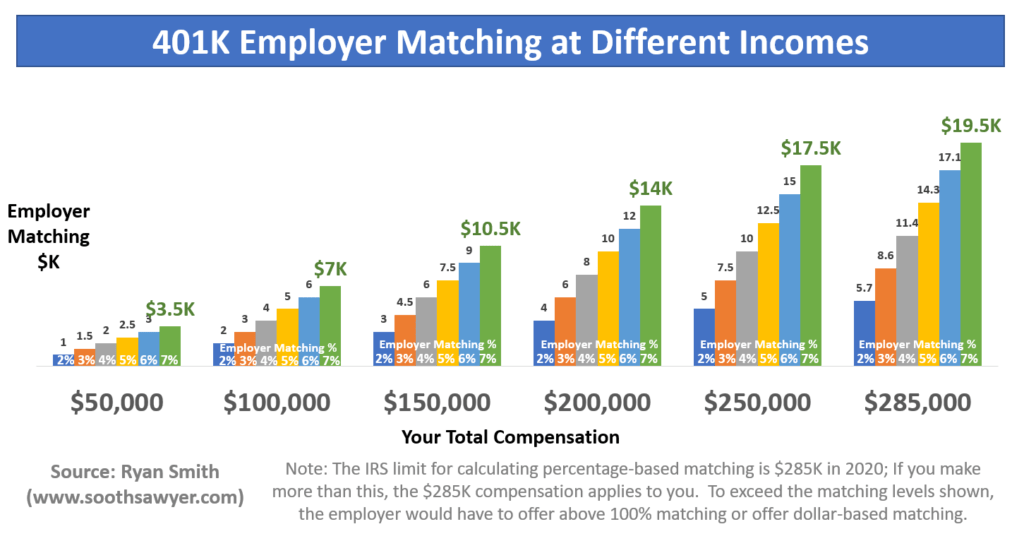

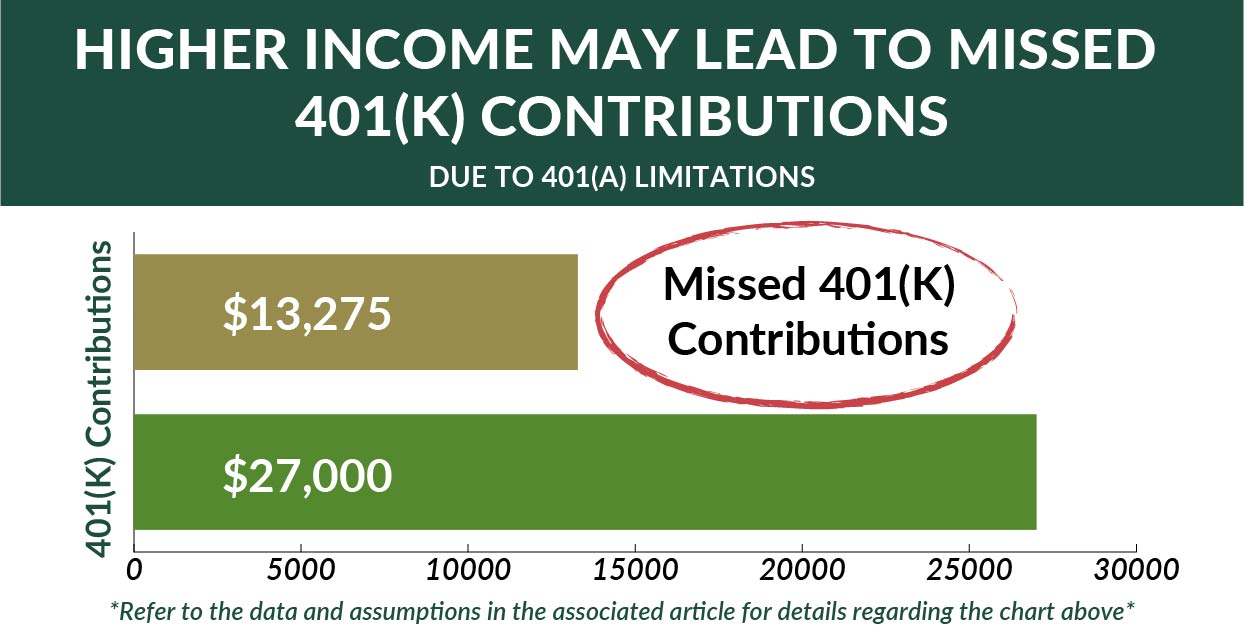

This calculator is provided only as a general self-help tool. This is the maximum percent of your salary matched by your employer regardless of the amount you decide to contribute. Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. If you want maximum funding for your 401k plan then determining the contribution percentage is straightforward even without a 401k max contribution calculator. A lower contribution limit can feel like theres a little less leg work ie.

We encourage you to talk to an. The accuracy or applicability of the tools results to your circumstances is not guaranteed. May be indexed annually in 500 increments.

This number is the gross pay per pay. This California 401k calculator helps you plan for the future. 401 k Contribution Calculator.

You can enter the. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Check with your plan administrator for details.

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. If you increase your contribution to 10 you will contribute 10000. Pre-tax Contribution Limits 401k 403b and 457b plans.

The earlier you start contributing to a retirement plan the more the power of compound interest may help you save. For example lets assume your employer. Your employer needs to offer a 401k plan.

Your 401k plan account might be your best tool for creating a secure retirement. This calculator has been updated to. According to the IRS you can contribute up.

You want to save for retirement and take advantage of your employers match in your 401 k plan but you arent sure you can afford to. You only pay taxes on. First all contributions and earnings to your 401 k are tax deferred.

It provides you with two important advantages. Lower contributions to be done to max out the account. You can make 401k contributions from your paycheck before tax is.

Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a.

The Maximum 401k Contribution Limit Financial Samurai

Download 401k Calculator Excel Template Exceldatapro

Download 401k Calculator Excel Template Exceldatapro

401k Contribution Calculator Step By Step Guide With Examples

401k Contribution Calculator Step By Step Guide With Examples

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

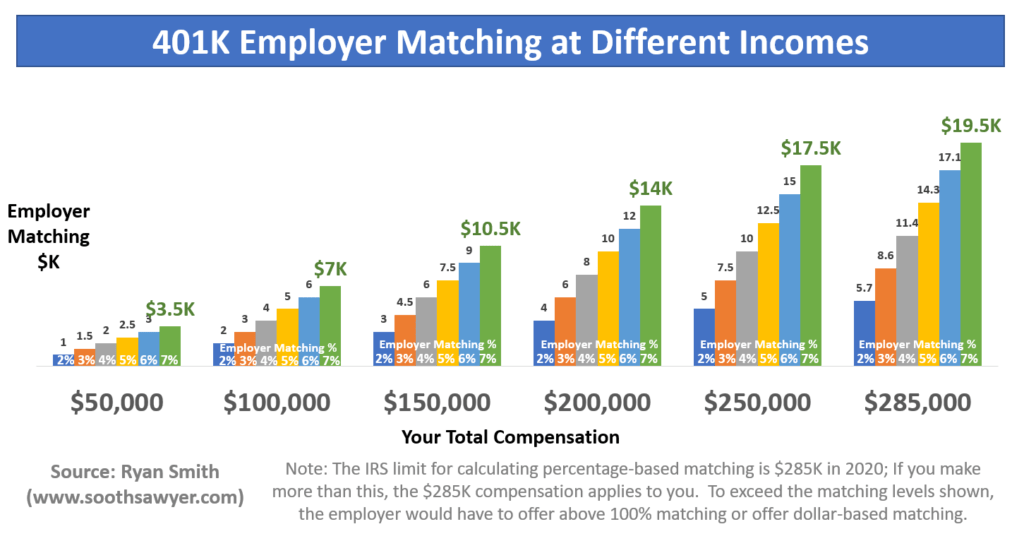

Doing The Math On Your 401 K Match Sep 29 2000

How Much Should I Have Saved In My 401k By Age

Solo 401k Contribution Limits And Types

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Doing The Math On Your 401 K Match Sep 29 2000

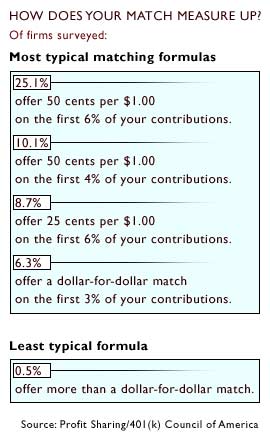

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

401k Contribution Impact On Take Home Pay Tpc 401 K

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

401 K Calculator Paycheck Tools National Payroll Week

How Much Should I Have Saved In My 401k By Age

Free 401k Calculator For Excel Calculate Your 401k Savings