Depreciation tax savings formula

To recover the carrying amount of Rs 100 the entity must earn taxable income of Rs 100 but will only be able to deduct tax depreciation of Rs 60. If this bond was converted however the net value of.

Depreciation Tax Shield Formula And Calculator

Cost of Rs 150 less cumulative tax depreciation of Rs 90 ie.

. The number of depreciation periods the value of the asset minus the final value which is then divided by the total value per. Since managers of businesses take the Time Value of Money into consideration its better to have the savings early rather than. This results in thousands of dollars in tax savings.

275 years and definitely 39 years is a really long. It creates a more significant depreciation which allows for greater tax deductions and minimizing the taxable income during the assets first years. Tax Shield Formula.

The effect of a tax shield can be determined using a formula. Thats right invest in more real estate and do the same thing with multiple properties. Youll write off 2000 of the bouncy castles value in year one.

ADS using straight-line method. The formula for straight-line depreciation is. This tax depreciation method uses the straight-line formula under the GDS that calculates an even depreciation amount over the assets life with the exception of the first and last year of service.

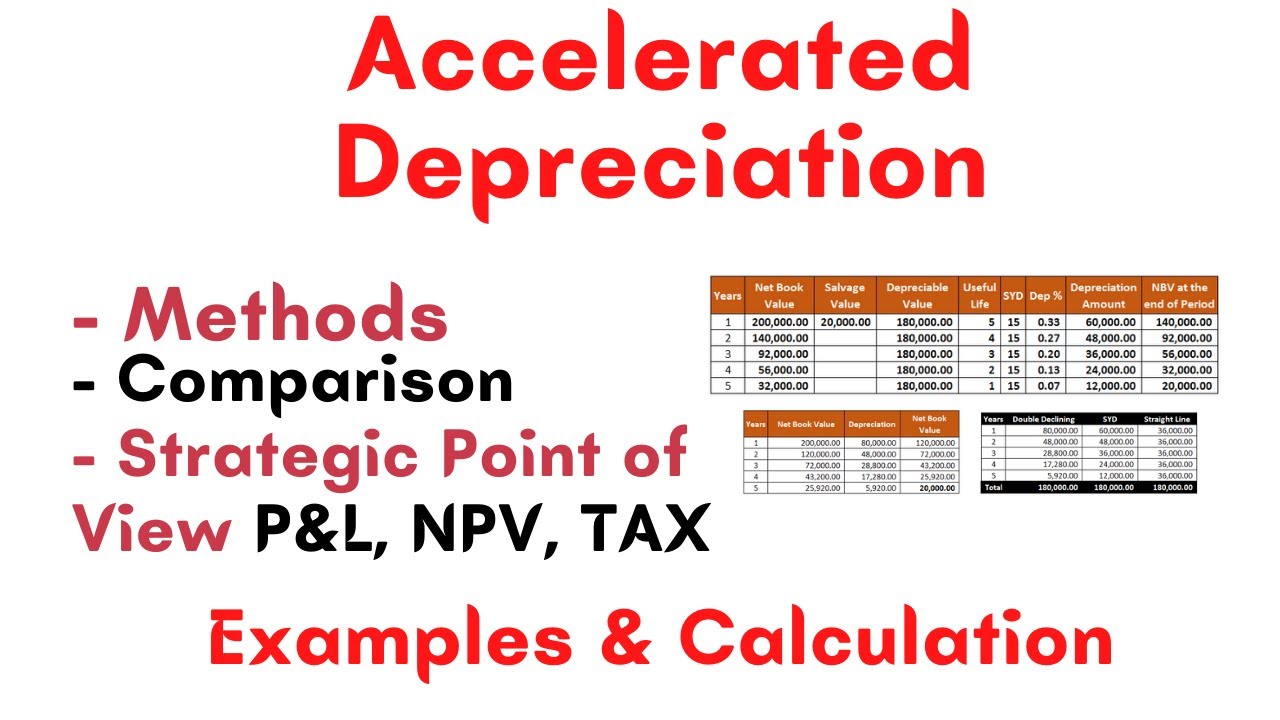

Double declining balance method. Now we know what you might be thinking. Double Declining Balance Depreciation Method.

Cars with typical depreciation rates might lose up to 58 of their value in three years 49 in four years and 40 in five years. Purchase cost- salvage valueuseful life. 2 x straight-line depreciation rate x book value at the beginning of the year.

Straight Line Depreciation Formula The following algorithms are used in our calculator. This class is for listed property used less than 50 of the time for business. This means the van depreciates at a rate of 5000 per year for the next five years.

The formula for calculating depreciation using each of these methods is given below. The tax savings would have been 280000 had the bond not been converted. The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset.

Rapid methods offer more tax savings in the early years and fewer savings in later years. Consequently the entity will pay income taxes of Rs 10 Rs 40 at 25 when it recovers the carrying amount of the asset. The depreciation per period the value of the asset minus the final value which is then divided by the total number of periods.

And you know what you could do with those savings. The accelerated method makes the asset lose value at a faster rate than the straight-line method. Depreciation Tax Shield Example.

Lets see an example of the depreciation formula. GDS using straight-line method. By using the formula for the straight-line method the annual depreciation is calculated as.

Depreciation is the single biggest cost of car ownership in Australia bigger than fuel servicing or insurance. Learn how depreciation works and leverage it to increase your small business tax savingsespecially when you need them the most. Now the book value of the bouncy castle is 8000.

To increase cash flows and to further increase the value of a business tax shields are used.

Npv And Taxes Double Entry Bookkeeping

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Income Taxes In Capital Budgeting Decisions Chapter Ppt Download

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Schedule Formula And Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Finance

Depreciation Schedule Formula And Calculator

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator

Accelerated Depreciation Methods Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Depreciation Schedule Formula And Calculator